Tax Form 1040 & Schedule 1: Comprehensive Additional Income Guide

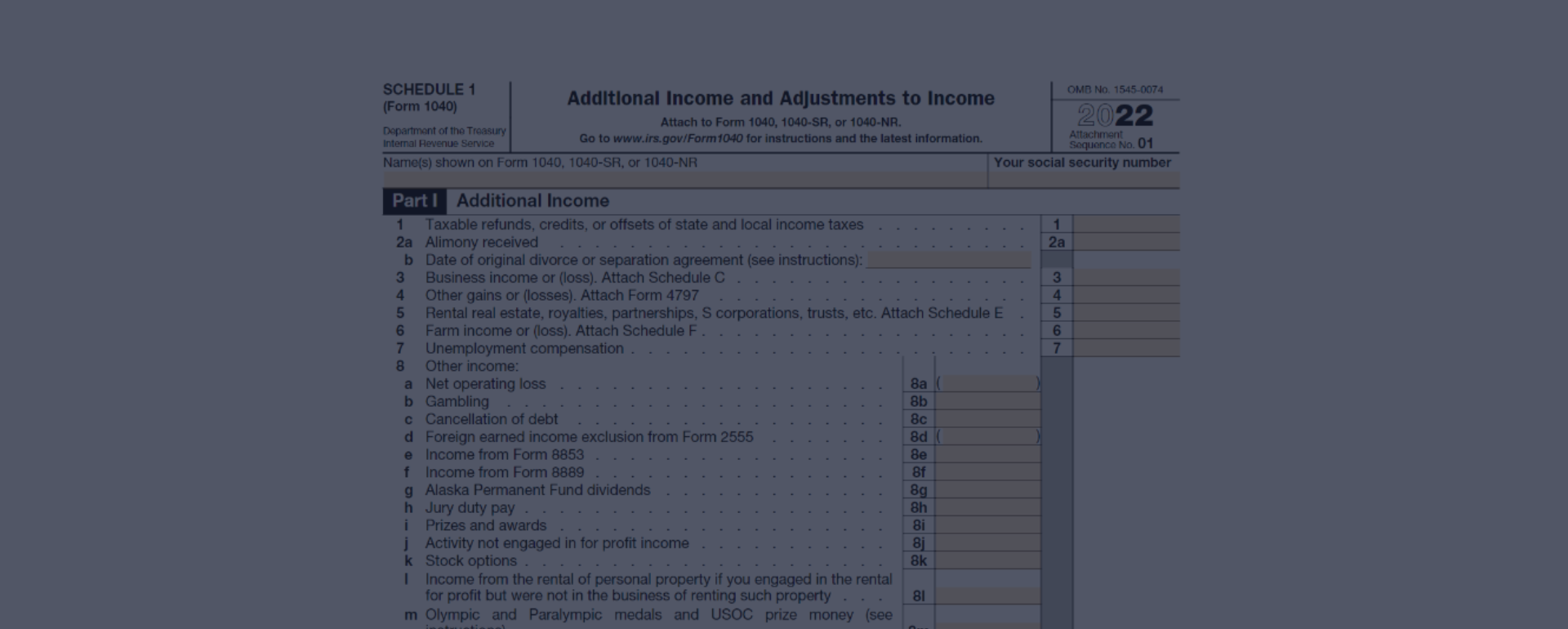

IRS tax form 1040 (Schedule 1) is an essential document for US taxpayers, as it allows individuals to report additional revenue and adjustments to their income tax. This template is used in conjunction with the main income tax form 1040, and it is required for those who have certain types of gain or deductions that are not accounted for on the primary copy. Applicable items may include rental revenue, alimony, or deductions for student loan interest. As tax laws and regulations change, it is crucial to stay updated and utilize Form 1040 (Schedule 1) for 2023 as PDF to ensure accurate reporting.

Complete Schedule 1 (1040) in 2023 With Ease

In today's fast-paced world, having access to a reliable source of information is vital for success. The website form1040-schedule1.com offers valuable resources, including printable IRS Form 1040 (Schedule 1), instructions, and examples to assist taxpayers in completing this sample accurately and efficiently. By using these materials, individuals can confidently navigate the complexities of the income tax form 1040 (Schedule 1) and submit their annual returns with ease. The website's user-friendly interface and expertly crafted content not only educate taxpayers but also empower them to take control of their financial obligations and make informed decisions. Trust form1040-schedule1.com to guide you through the process and ensure a seamless tax filing experience.

Tax Form 1040 (Schedule 1) Purpose & Using Terms

According to the IRS Form 1040 (Schedule 1) instructions, individuals must file this copy if they have additional income or adjustments to revenue that cannot be entered directly on individual income tax returns. This may include items such as alimony, business earnings, rental revenue, or student loan interest deductions.

Meet Sarah, a freelance graphic designer who must file the 2023 Form 1040 (Schedule 1). Over the past year, Sarah has experienced a significant increase in her business income. In addition to her regular clients, she has taken on several new projects, resulting in higher earnings. Since her income is not from a traditional employer, Sarah must complete Schedule 1 to report her additional income to the IRS accurately.

On the other hand, we have John, a college professor who also needs to file the federal tax form 1040 (Schedule 1). John is a homeowner and recently decided to rent out a portion of his property for supplemental income. These rental earnings must be reported on Schedule 1 to ensure proper taxation. Additionally, John has been diligently paying off his student loans and is eligible for a student loan interest deduction. This adjustment to his income must also be reported on IRS Form 1040 (Schedule 1) for 2023 to reduce his taxable earnings.

Don't Miss the Due Date

The deadline to file your tax form 1040 (Schedule 1) is typically April 15th, but it's crucial to double-check the IRS website for any changes. Meeting this deadline is essential, as failing to submit the IRS Form 1040 (Sch 1) on time can result in penalties. These penalties include fines and interest charges for late filing, and even more severe consequences for providing false information. It's important to prioritize the accuracy and timeliness of your tax filings to avoid these potential setbacks.

Fill FormPrimary 2023 Schedule 1 (Form 1040) Assignments

-

![Additional Incomes]() Additional IncomesSchedule 1 captures various income sources not included in the main Form 1040, such as alimony, business income, capital gains, rental earnings, and unemployment compensation.

Additional IncomesSchedule 1 captures various income sources not included in the main Form 1040, such as alimony, business income, capital gains, rental earnings, and unemployment compensation. -

![Deduction Details]() Deduction DetailsIt allows taxpayers to report specific deductions, like educator expenses, student loan interest, and self-employed health insurance, ultimately lowering taxable income and potentially reducing tax liability.

Deduction DetailsIt allows taxpayers to report specific deductions, like educator expenses, student loan interest, and self-employed health insurance, ultimately lowering taxable income and potentially reducing tax liability. -

![Extra Adjustments]() Extra AdjustmentsSchedule 1 provides a platform for reporting additional adjustments, such as Health Savings Account deductions and IRA contributions, ensuring accuracy in any calculations and maximizing potential tax benefits.

Extra AdjustmentsSchedule 1 provides a platform for reporting additional adjustments, such as Health Savings Account deductions and IRA contributions, ensuring accuracy in any calculations and maximizing potential tax benefits.

Schedule 1: Instructions to File it With IRS Form 1040

- Begin by visiting our website to access the instructions for IRS Form 1040 (Sch 1), ensuring you have accurate guidance throughout the process.

- Familiarize yourself with the form's structure and requirements, which will help you avoid errors when completing it.

- Locate the 1040 (Schedule 1) fillable form for 2023 on our website, either to download and print or to complete online.

- Gather all necessary documentation, such as income statements and tax-related records, before starting the template.

- Follow the step-by-step instructions provided on our website, focusing on one section at a time to avoid confusion.

- Double-check your entries on the IRS Form 1040 (Schedule 1) to ensure accuracy and avoid potential errors.

- If you encounter any difficulties, consult our website's resources and support for clarification and guidance.

- Once you've completed the form, review all entries one final time to ensure a successful submission.

- Submit your fillable Schedule 1 PDF online or mail it to the appropriate IRS address.

- Keep a copy of the completed sample for your records, as well as any supporting documentation you may need in the future.

Printable Schedule 1 Sample

Using the IRS Form 1040 (Schedule 1) printable version allows taxpayers to fill out the sample physically and have a hard copy for their records. By choosing this way, individuals can easily review and make any necessary corrections before submitting the document. The printable version also provides a tangible reference for future tax filing, ensuring accuracy and consistency in the information provided.

Fillable Schedule 1 PDF

Alternatively, taxpayers can benefit from online filing Schedule 1 (Form 1040) for 2023 as PDF. This method offers ease of access, faster processing, and increased security, as the information is submitted directly to the IRS. Additionally, online filing reduces the likelihood of errors, as the system automatically checks for discrepancies or missing information. This saves time and effort for both the taxpayer and the IRS, ensuring a smooth and efficient filing process.

File Online

IRS Form 1040 (Sch 1): People Also Ask

- How do I access the Schedule 1 (Form 1040) PDF for 2023 on your website?Simply follow the link on our website by typing the button “Get Form.” There, you will find a page where you can download the latest version of the sample. Click on the link, and the PDF will be available for download or online use.

- Can I fill out Schedule 1 directly on your website?Yes, our website offers an interactive, fillable version of Schedule 1 (Form 1040) that you can complete online. Once you've filled in the required fields, you can easily save, print, or submit the sample as needed.

- What is the purpose of Schedule 1 of Federal Form 1040?It reports additional income and adjustments to income that are not reported directly on Form 1040. This includes alimony, business revenue, rental gain, adjustments for educator expenses, student loan interest, or contributions to a traditional IRA.

- Am I required to file Schedule 1 with my tax return (1040 form)?You need to file Schedule 1 only if you have additional income or revenue adjustments not reported on standard Form 1040. If you're unsure whether to file Schedule 1, consult a tax professional or review the instructions provided by the IRS.

- How can I ensure that I fill out Schedule 1 and IRS tax form 1040 correctly?Our website offers comprehensive guidance and resources to help you complete Schedule 1 accurately. Along with the fillable form, we provide detailed instructions and examples to guide you through the process. Additionally, consider consulting a financial professional if you have any doubts or complex tax situations.

Federal Tax Form 1040 (Sch 1) Instructions for 2023

IRS Form 1040 (Schedule 1) Printable Accessing a printable IRS tax form 1040 (Schedule 1) is easy and convenient from our user-friendly website. With our simple navigation system, you can quickly find the 2022 Form 1040 (Schedule 1) template you need. Just follow these steps: Navigate to the top of the main page on our website or ou...

IRS Form 1040 (Schedule 1) Printable Accessing a printable IRS tax form 1040 (Schedule 1) is easy and convenient from our user-friendly website. With our simple navigation system, you can quickly find the 2022 Form 1040 (Schedule 1) template you need. Just follow these steps: Navigate to the top of the main page on our website or ou... - 10 April, 2023

- 2023 Form 1040 (Schedule 1) Instructions Hey there, fellow taxpayer! If you're reading this, chances are you're looking for some guidance on how to navigate the somewhat murky waters of the IRS Form 1040 (Schedule 1). Fear not, for we're here to help you understand the ins and outs of this vital tax document. In this article, we'll explore...

- 7 April, 2023

- Federal Tax Form 1040 (Schedule 1) So you're getting ready to tackle your taxes and you hear about this Schedule 1 attached to the good ol' Form 1040. Don't worry, we've got you covered! In this article, we will dive into the history, the purpose, and everything else you need to know about the tax form 1040 (Schedule 1) to make your...

- 6 April, 2023

Fill Out IRS Form 1040 (Schedule 1)

Get FormPlease Note

This website (form1040-schedule1.com) is not an official representative, creator or developer of this application, game, or product. All the copyrighted materials belong to their respective owners. All the content on this website is used for educational and informative purposes only.